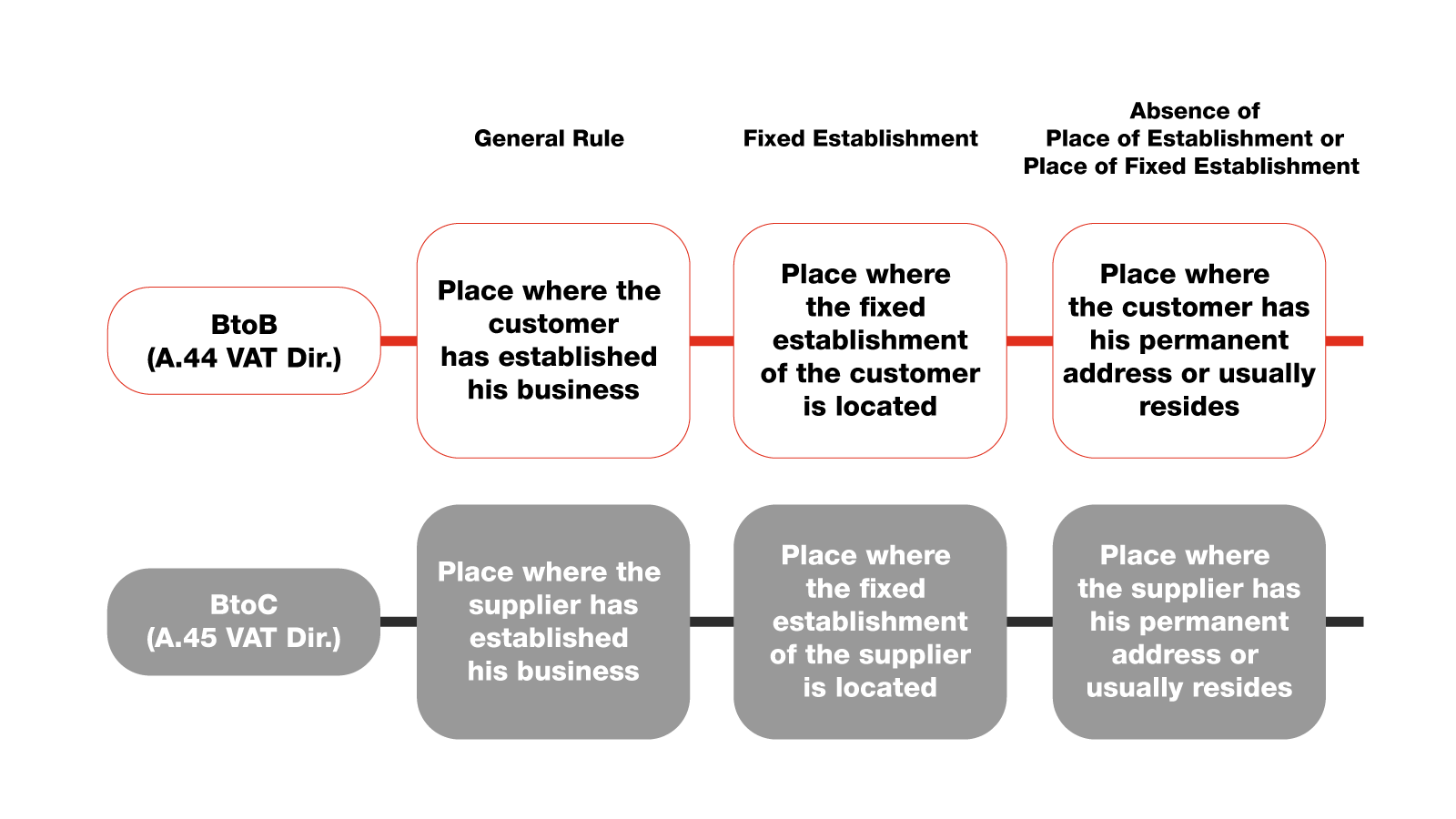

TaxmannWebinar | Fixed Establishment under Indian GST – Decoding with EU VAT Jurisprudence - YouTube

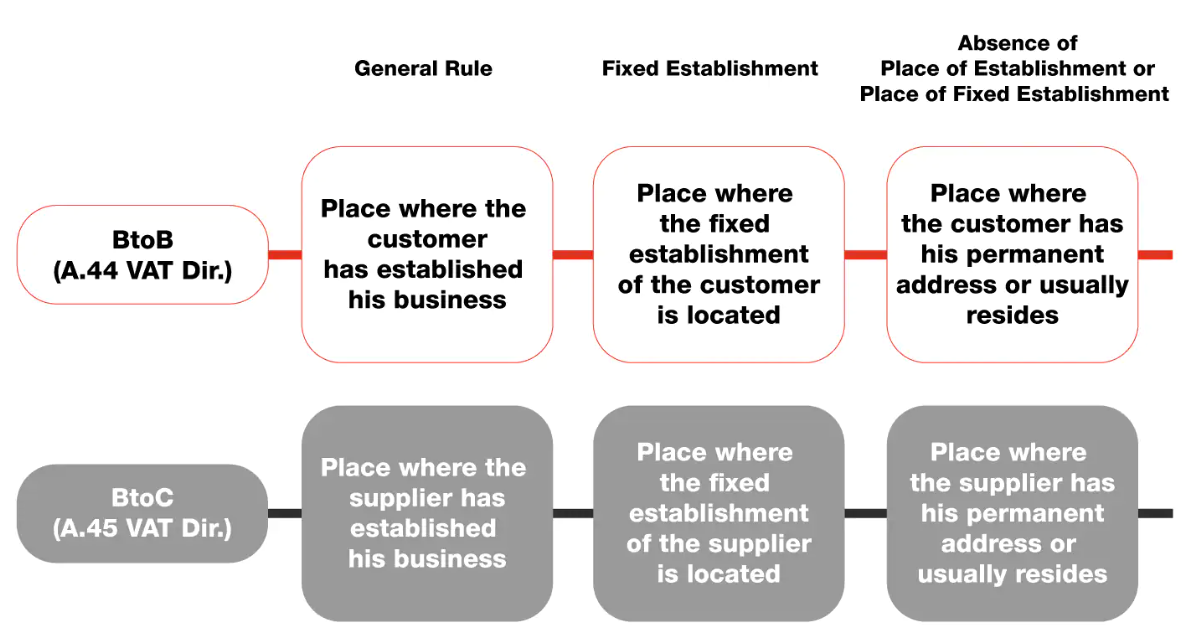

Fixed establishment even in the absence of own human and technical resources? | KMLZ Rechtsanwaltsgesellschaft mbH

Place of Establishment V/s Fixed Establishment | UAE VAT laws | Learn under a minute #learninaminute - YouTube